Fritz Crusius, June 2022

Leaving Canada, I just paid a tax penalty of $45,435.74. That’s on top of the roughly $1,500 for filing delays. And doesn’t yet account for interest or possible other charges from Canada Revenue contesting the complex declaration I had to prepare. If unlucky, I could get a lawsuit on top. Curious how this happened to me and what you could do to avoid similar problems? Then this article is for you!

First off, let’s be clear I always paid all my taxes, never concealed any earnings, had tax advisers and listened to them. My misdemeanor was to come to Canada as an immigrant with moderate retirement savings located in Germany. This placed me under foreign income surveillance with deemed acquisition and disposition of my Berlin apartment. As if the property had been given to me as a present when I first came to Canada, been sold with significant gains when I left, and part of the spoils rightfully belonged to Canada. When in reality I quit my job, had very little income and might well have been bankrupted.

So I decided to write up my insights on what I believe is wrong with Canada, followed by a short economic essay on likely political motivation, and afterwards some specifics on Canada’s punitive taxation with hopefully useful hints for people in a similar situation. I realize much of what I have to say won’t go down well with Canadians. Comments are open, let me know if anything is counter-factual.

Part 1: What’s Wrong With Canada

In all I had a good time in Canada, but looking back it feels like I spent nine years in a winter sports resort I thought was all-inclusive until I was handed my drinks bill for check-out. Some $15 in daily consumption. Time for rehab from an initially happy marriage turned sour after the bride revealed her true character of Land of Cold and Penalty. O Canada!

I would like encourage anyone interested in Canadian immigration to consider possible downsides of becoming a Canadian resident, as tax implications could turn out harsher than frosty climate. Ceasing to be resident, you may have to extricate yourself from a spider web of legislative pitfalls adding fictitious capital gains to your taxable income. There are more downsides to Canada not everyone knows about. Costs of living are high with significantly reduced consumer product variety and job opportunities compared to the US. And because of its high taxes and antiquated banking system, Canada isn’t a particularly good country for running a business either. Also note that the supposedly free public healthcare isn’t as much of a boon as you might think.

I have been long-term resident in Germany and the United Kingdom and both were a better fit for me. My advice for would-be immigrants is to shop around and compare potential countries to settle in.

Leaving Canada was my only option to escape illogical, punitive and possibly ruinous taxation. To get away, I had to invest considerable time, effort and sunk costs producing an expatriation declaration. Having gone through this ordeal, I could envision few scenarios where returning to Canada might be in my best interest:

- A nuclear war or similar catastrophe in Europe affecting Canada to a lesser degree.

- Being impoverished at old age and in need of free, albeit crappy healthcare. And I have an idea how Canadian emigrants might get into that situation.

Anti-Immigrant Taxation

When I immigrated to Canada I was already in my forties with moderate retirement savings located in Germany from my decades of working in Germany. Because Canada treats foreign investments differently from domestic ones, my German possessions placed me under special foreign income surveillance. Initially I thought this was a form of millionaire taxation gone wrong for immigrants. But actually, snow birds have no problems with their Florida condos so long as they can demonstrate some self-use. Since native Canadians are also much less likely to eventually cut residential ties, the step triggering the departure tax procedure with deemed disposition of all property, then whom are Canadian politicians targeting here?

One could argue whether millionaire Canadian residents knowingly investing in foreign property deserve punitive surveillance and taxation. But applying such rules to immigrants having moderate possessions in their countries of origin from before coming to Canada is demonstrating a lack of decency on side of the Canadian government. There seems to be a regrettable attitude that immigrants, in exchange for the great generosity of being allowed to work and pay taxes, owe Canada big time. Like a share of everything they had from before coming to Canada. And of their family estates, too, should they inherit whilst being Canadian residents.

Welcome to the Wonderful World of the T1135, Canada’s Nuclear Option for Foreign Investors

Canada Revenue’s Foreign Income Verification Statement, form T1135, is something of a nuclear option for Canadian residents investing in the foreign.

If the total value of your foreign investments exceeds a threshold of CAD $100,000 at any time during the year, you need to fill a T1135. Knowingly omitting assets risks a penalty of $500 per month up to a total of $12,000. I’m not sure if that’s per position, or if it’s rather the greater of $24,000 or 5% of the total cost. In any case, a lot. Note that there are no “due diligence” exceptions for the T1135. Missing a foreign bank account statement? Pay $25 in penalties per calendar day until you recover access.

Calculating total cost “at any time during the year” requires multiplying stock prices with foreign exchange rates on a daily basis. Hopefully you’re savvy with Excel and love matching ECB FX rates to Yahoo charts data! Oh, and you need to come up with appraisals for your real estate. Since these will only ever be estimates, it’s in the discretion of Canada Revenue whether or not you fulfilled your “information” obligations. Don’t want to afford a professional appraisal for your condo each and every year of your stay in Canada? That’s again the $24,000 in penalties, I guess.

And good luck spotting all non-Canadian stock positions in your portfolio. Companies aren’t already Canadian just because they are traded on the Toronto Stock Exchange.

Good Canadians Invest Canadian

One wonders why, in the age of electronic trading, there should be any differences taxing foreign and domestic investments? I’m speculating: maybe Canadians should favor Canadian businesses to make Canada more independent from its mighty neighbor, the US? Canadian authorities appear to be firmly stuck in the past. They also struggle to come up with sensible rules for crypto-currencies. Since no one knows where Bitcoins are physically located, they should “very likely” be treated as “specified foreign properties”. Even tax lawyers can’t tell you for sure. That this would otherwise be plain laughable will be one motivation for all those five digit penalties on the T1135.

In Banking the Middle Ages

Still stranger is Canada’s lack of fully functioning day-to-day banking. One can’t just take someone’s name and bank account number and then transfer between regular current accounts. There are workarounds so cumbersome for book-keeping purposes that many small businesses, including my Montreal landlords, still prefer using cheques. That’s the middle ages in financial technology and neither the government nor Canadian big finance seem to be willing to do anything about it. No, they want to keep accounts closed and mini-improvements, such as an option for depositing cheques by scanning them with mobile apps, are touted as a major innovations.

For big finance, this works out well. But for small businesses it’s a drag. In my account there was a one-off fee of $50 for adding a function for adding payees, and then a $5 charge per payee. Of course, a payee in Canada is same as in Europe, someone’s name and account number. Even for paying taxes I needed a special application charging $2 per transaction. Oh, and tax slips never mention a Canada Revenue or Revenue Quebec account number. It’s your responsibility to find the right payee by name.

Fun fact: when Canadians ask your account details for normal transfers called “direct deposits”, they don’t accept it when you give them your bank account number. It’s still cheques! You need to look for a “void cheque” option in the service menu of your online banking, which will print an invalid cheque with your account number at the bottom. Don’t just mail it as a PDF. Canadians are happiest when you hand them a paper copy!

Struggling with Documents for Expatriation? Never a worry, Canada Revenue is Here to Help!

As a Canadian emigrant you will need extra documentation for your last tax return. Struggling to get a professional appraisal for the value of your condo from ten years ago? Never a worry, Canada Revenue is here to help. Because you’re no longer resident and very likely outside Canada, your tax return won’t be “eligible” for electronic filing. No, it has to be mailed in paper. And it’s of course your responsibility that your letter, sent from overseas, reaches Canada Revenue Agency by April 30. To help you find sufficient time for possible mailing delays, Canada Revenue triples penalties for you. Per day of late filing, it’s $75 instead of just $25. In addition to the beloved T1135, you’ll have to list your “gains” from the deemed disposition of your property in the T1243, and again the property for deemed disposition in the T1161. So the T1161 gives no extra information, it’s purpose is probably just to double up penalties.

As an alternative to mailing paper returns, Canada Revenue has one fax machine ready for you, but really only as a pandemic relief measure. Try often, the poor thing is almost always busy. I’m not sure who would be to blame for technical malfunction. Wouldn’t surprise me if they charged more of their $75 penalties until the day they let you know your fax wasn’t legible.

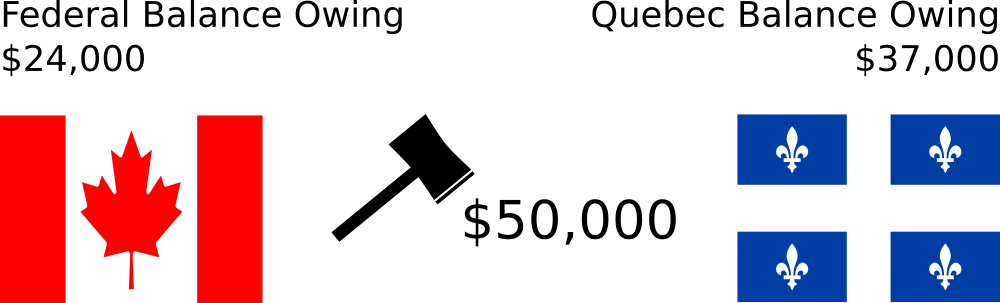

Quebec is Special

Quebec is special. Or high maintenance, as Canadians from other provinces like to put it. Everywhere in Canada, you declare taxes twice, federally and provincially. However, you pay considerably more to Revenue Quebec than any other province’s collection office. This extends to any departure tax penalties should you ever emigrate. And your kids will need to attend a French school as Quebecois are quite nationalist, many of them favoring independence from Canada.

ABCDEFGHIJKLM

NO PQ

RSTUVWXYZ

The old joke of the Canadian alphabet, all letters normal, except for NO Province of Quebec

In the old joke of the Canadian alphabet, all letters normal, except for NO Province of Quebec.

As such, live is good in Quebec, housing more affordable than in other provinces, and options for outdoor activities better than in Ontario. Just be aware of the hidden fees.

Mediocre Public Healthcare

Canada’s reputation for being a relatively European country with good public healthcare, as opposed to the US’ lack of universal healthcare, is partly based on misinformation and negative stereotypes. Yes, public healthcare is free in Canada, but taxes charged may turn out higher than private medical bills elsewhere. Even just for prescription drugs Assurance Maladie du Quebec adds $661 to your income tax bill if your employer’s medical plan doesn’t cover them. Whether you needed any drugs or not.

And at the pharmacy, you still pay extra for each item. However, without family doctor and proper access to specialists, you may not be seen by too many medical doctors anyway.

I’m not saying one cannot get good medical care in Canada. But consider the consequences of a two year wait on a family doctor. What this says is that in public healthcare supply doesn’t meet demand. Normally, this happens when a monopoly purposefully produces less in order to raise prices and reap monopoly profits. Medical doctors in Quebec earn an average $311,000 anually, and what could go wrong for them with two years of patients in the wait?

Would you try harder if you didn’t need to compete with your colleagues? Maybe, if you loved your profession and took helping people as the purpose of your life. But economic theory can’t be that wrong in its predictions of what would be a more likely result. In my experience, between Quebec and German healthcare there’s a difference of night and day.

A Quebec Health Anecdote

When I was hit by a car in 2016, with one of the bones in my right wrist reduced to mesh, Quebec Health put me on Ketamine, a hallucinogenic party drug also used as horse tranquilizer. They then pulled my wrist somewhat straight, stabilized it in a splint, and no two hours later sent me off with blood stained clothes in a shopping bag. I was in a good mood, the sun shining, and I found home walking. Despite seeing the world in colorful diagonal stripes shortly before. On an Oxycodone prescription I subsequently spent 7 days waiting for surgery. Right before the operation the orthopedic surgeon gave me 30 seconds to decide whether I’d prefer nails or an implant in my wrist. At least they benevolently granted me one night inpatient because I was living on my own. Good times! Normally, they have no problems pushing you to the hospital exit in a wheelchair and what happens afterwards will by your responsibility.

Stiff Politics

Canada has a First Past The Post election system, where winning candidates represent electoral districts or “ridings”. This system grants disproportionately high numbers of mandates in parliament to the strongest, most established political parties and makes it hard for newcomers to gain momentum. In his 2015 campaign, Trudeau promised legalization of marijuana and a change towards proportional representation in the federal election system. Legalization went into force in October 2018, but the push for electoral change made no progress. If parliamentarians rather change convictions on long held drug beliefs, it shows just how hard it is to replace an electoral system from within that system. Whatever rules allocated the seats in the assembly would have benefited current members of parliament, who will see change as a reelection and personal career risk.

So Canada is stuck with its FPTP and, by and large, two party system. On the conservative end of the spectrum there are provincial variations that lately helped Trudeau to remain in power. His Liberals fell short of a majority but remained strongest party, allowing Trudeau to continue as head of a minority government. No one seemed to mind his corruption scandals, such as the SNC-Lavalin affair. It’s probably always been like this and is by now considered normal.

Trudeau is helped by the dismal condition of the main opposition, the Conservative Party of former prime minister Steven Harper. After each lost election it engages in a leadership contest bluntly dismissing the last candidate, whether or not disappointing results were any of his fault. Coalition governments are the exception to one party rule, though Trudeau lately secured support from the more more progressive New Democratic Party for a full term in power.

A Resentful Country at Core

Have you wondered why Canadians apologize that much? And are always trying to be so over-polite? At my work it was driving me crazy that, during morning rush hours, it was rarely possible to depart in already over-full elevators because Canadians always needed to keep doors open for the next person to enter. Even if there were two more elevators ready to use and the habit clearly resulted in a slow-down for everyone. But don’t you dare pointing this out, and that the constant triggering of barrier sensors on the doors likely contributes to wear and tear. You may be experiencing the harsh side of Canadians with statements such as you being the worst colleague who no one wants to work with ever!

Forgiveness isn’t the strongest point of Canadians indeed. No need to look further than the long held grudges of French Canadians for what the “Anglos” did to them some 200 years ago. Or punitive taxation for supposed millionaires. Or hitting out on immigrants leaving after a couple of years. Or continued restrictions on travelers that were, for much of the pandemic, way tighter than what was practiced between countries of the European Union, all because at some point it must have been a traveler bringing the disease.

Part 2: Economies of Berlin Walls

The Berlin Wall was built in 1961 and is an extreme example of government regulation. Economic development in communist Eastern Europe was lagging the booming capitalist West and skilled workers were leaving East Germany in droves. The communist government of East Germany, pressed to do something, decided to fix the problem by raising the price for leaving to possibly dying. Apart from the daring few risking to be shot trying to scale the wall, eastern residents would now see it in their best interest to stay and put up with whatever eastern rulers were throwing their way. And since a society with soldiers shooting citizens can only be maintained by oppression, the situation kept deteriorating until the Berlin Wall finally fell in 1989. In hindsight eastern rulers would have been much better advised to simply step aside and allow free markets to find an east-west equilibrium.

Why Governments in General Dislike Free Movement

Most governments dislike free movement to some extent and impose restrictions on entering their countries. And unless there are some mutual agreements like between countries of the European Union, almost everyone will need resident or work permits for almost all countries. In a globalized world with free movement of goods and services it’s not obvious why the people using them should be restricted. Since businesses will move production to low wage countries if low wage workers are barred entry, we can expect adverse outcomes like higher unemployment in countries shielding their labor markets from competition. There is however some common sense in arguments that not everyone can move to the most attractive countries with best infrastructure and social systems. In an ideal world everyone should be allowed to work and settle anywhere, and also be entitled to a comparable level of social welfare. The only problem is that a worldwide equal social welfare standard would likely result in zero social security for everyone.

For the point of this discussion, let’s summarize that limiting incoming migration cannot be dismissed as completely inhumane or unreasonable, though economic outcomes may be unfavorable.

The Case for Restricting Emigration

While few countries allow unlimited immigration from anywhere in the world, many impose no restrictions whatsoever on emigration. For one, the freedom to leave is a basic human right in democratic countries with liberal constitutions. Moreover, the reasons for limiting incoming migration, such as protecting social systems or prevent overuse of resources, all don’t apply to emigration. Usually it will be some form of dictatorship going to the extreme of preventing subjects from exiting.

Historically, serfs were not free to leave the principalities of feudal lords in order to offer their skills in a labor market. It was one of the key innovations of capitalism to change this and enable money to allocate workers more efficiently. This in turn enhanced capitalist societies, enabled progress and generated welfare. But keeping back serfs for the benefit of exploitation would have been in the interest of feudal lords, who also didn’t necessarily approve of transitioning to an industrial economy because they were elite in the current system. Interestingly, the nobility’s short-term advantage effectuated their own undoing in countries falling too far behind during the era of industrial revolution.

In short, restrictions on emigration indicate internal political problems and are a clear disadvantage for the long-term prospects of countries.

Border Fences Canadian Style

I don’t mean to imply Canada is a communist style dictatorship shooting people trying to cross its borders in search for a better life. Only financially, emigrants may be unlucky to get virtual bullets into their backs. That still invites totally unflattering comparisons and begs the question why Canadian politics imposes such stiff penalties for leaving.

One reason why Canada hits out on emigrants with deemed dispositions will be the allure of quick money. Squeeze as much as you can from immigrants coming to your country to work and pay taxes. The other reason I could think of is to provide “incentives” for long-term residents to stay on. Not just unlucky immigrants turning emigrants, but also native Canadians may struggle paying up fictitious capital gains on property resulting in real bankruptcy risks. Admittedly, the US also charge departure tax and some sources praise the wisdom and justice of the Canadian versus the US system. The US, however, doesn’t tax to poverty like benevolent Canada.

It’s not just departure tax where Canada sanctions quitters. Residents staying outside the country for too long lose entitlements for health coverage, limiting the time pensioners could spend in warmer climates. The maximum leave is 182 to 212 days in any 12 month period, depending on province.

Moreover, the absence of a free-movement agreement between the US and Canada allowing citizens on each side of the border to work and live in both countries is probably more important to Canada than the US, as otherwise too many skilled Canadians might seek opportunity in the US.

It’s however been requirements for travel documentation where thought the federal government was recently crossing lines. I understand security concerns and possible frustration with a recalcitrant minority. But no matter how big the disagreement, that minority should always retain a right for leaving and, if the majority so wishes, never come back. That’s a basic human right and how England handled its Puritans, why shouldn’t this be possible in modern day Canada? Nothing against Puritans, btw.

Why Canada Sanctions Quitters

So Canada is putting up barriers for leavers and the political motivations, I’m afraid, overlap to some degree with the reasoning of eastern rulers when they decided to build their wall. In the case of East Germany the communist economic system couldn’t be changed because it was enforced by Soviet occupation, and was making a stay in the country unappealing. For Canada, it’s the cold climate and long stretched geography putting it at a disadvantage relative to its larger neighbor, the US.

Where in warmer countries the homeless survive in the streets, Canadians would be stepping on ice mummies. So in Canada a comprehensive social system, which usually includes universal healthcare, is a necessity and needs be paid for. The cold is also exacting a toll on infrastructure like roads and bridges, which, combined with the size of the country, results in a huge financial burden and high taxation. Canada is at the same time a very expensive country to live in. I don’t think that thin stretch bordering the Arctic would be economically sustainable without the ready supply of goods from the US, especially food during the up to seven winter months. Still, markets offer noticeably less variety in all kinds of goods, including electronics and clothes, than south of the US border. And a lot of online stores don’t deliver to Canada because of all the hassle with duties.

Duties and taxes levied to deal with the country’s unfavorable natural conditions add to its lack of appeal. This is where the vicious circle to East Germany building its wall closes. When the exodus of skilled workers is starting to bite, make it harder to leave. Which in turn is yet another incentive for packing up.

What Canada Could Do to Improve

The Canadian government is rightfully trying to address the problem by attracting highly skilled immigrants who, with a job offer, can get Canadian permanent residence within weeks and apply for citizenship just three years later. Unfortunately for Canada, the brain drain issue remains as many of those immigrants head south to the US as soon as they become Canadian. Some may even be on time to quit before they complete their 60 months of residence, thus dodging departure penalties on property they had from before Canada.

The most obvious solution that’s not going to go down well with Canadians is for Canada to stop being an independent country. The US invited Canada to join already in its Articles of Confederation.

I understand the cultural differences and why Canadians value their independence. An alternative to closer alignment with the US might be membership in the European Union.

Or maybe the European Union, Canada and the US should all join a superstate with citizens moving and residing freely like it’s currently practiced between countries of the EU 27.

Of course, there’s a problem of different social standards and adverse selection to overcome. If Canada and the US were to enter a free movement agreement, it might be skilled Canadian workers moving to the US and Canada getting the poor taking advantage of better welfare. But then, I’ve seen in what dismal conditions welfare recipients lived across my street in Plateau Montréal, in basement rooms with police popping by every week.

There would also be a lot Canada could do to lower taxes by being more efficient and less corrupt. Take Quebec and streets with potholes. The Commisson Charbonneau found corruption boosting the road construction budget by an incredible 30%. SNC-Lavalin ringing a bell, Mr. Trudeau? And is it really not possible to get family doctors for everyone with two years notice in the public healthcare system?

Being separate and independent from everyone is an expensive luxury and the reason why Quebec, despite all attempts, is still part of Canada.

But whatever you do, please stop lashing out on immigrants coming to your place to work and pay taxes, or deserve a reputation as Land of Cold and Penalty. The rules around departure tax were top on my list for giving notice on my job and leaving. If not for that, I would probably have worked in Canada until retirement age. Around now, we’re break even between the quick cash from all the penalties and what I would have contributed to the Canadian budget by staying on. To me it seems Canada tries hard chasing off immigrants, the more taxes they pay, the faster, and make sure they never come back.

Part 3: Canada Departure Tax Declaration

Preparing my last Canada tax declaration was a true nightmare. The only help I could get was from my German tax advisers, which I still had from my time as an IT contractor. In Canada I was an employee and my annual declarations, apart from the T1135 Foreign Income Verification Statement, were quick and easy. I copied some numbers from my payslips, ticked off a box for employer health cover, and that was it. Therefore I had no Canadian advisor and at the time of leaving found it impossible to get a new one, because the request for help with departure tax signals a lot of work for a one-time customer. Even an agency specializing in movers between Canada and the US rejected me because they had no clue about the specifics in Germany.

The complexity of departure tax declarations for expats moving back to Europe makes tax advisers struggle. For questions to Canada Revenue I was usually referred at least two times until I had someone knowledgeable on the phone.

So my first advice is to find a good tax adviser well before moving away from Canada. Or get out of the country quick enough, the worst of departure tax doesn’t kick in until you spent 60 months of residence. In any case, a disclaimer: I’m not a tax adviser myself, what I’m giving away here is no advice, and I shall not be responsible if you take it for that.

Your Residence Status

If becoming non-resident obligates you to pay a significant departure tax, the first question to clarify is whether it might be best for you to keep residential ties to Canada whilst physically residing outside the country. As long as Canada Revenue considers you resident, and it’s at their discretion whether they do so or not, you will be required to pay Canadian taxes on your world-wide income, as well as to fill the beloved T1135 with all its associated penalties. On the upside of staying resident, you won’t need to pay departure tax. On the downside, the longer you keep your resident status, the higher the departure penalty tends to become when you finally do cease to be resident.

As the previous paragraph implies, whether you’re Canadian tax resident is not as easy as you physically residing in the country for more than 182 days a year.

Canada Revenue wants you to consider “significant” and “secondary” residential ties. You having a home, spouse or dependants in Canada are significant ties, whereas personal property, a bank account, driver’s license, and passport are all secondary. You could be a factual resident, ordinarily resident, deemed resident, deemed emigrant, deemed non-resident and the linked details are only general in nature. In short, the rules are a mess and only aggravated by the dates of starting and ceasing to be resident being equally unsure.

If you had your Canada PR card for several months or years before actually moving to Canada, you may ask Canada Revenue about your residence start date filling form nr74-17e, or just use your most convenient date for your declaration and let them contest if need be.

In absence of significant residential ties such as job or home, the date you took your flight out of the country will usually mark the end of your residency. The less time you afterwards spend in Canada, the safer. Ironically, having a Canadian passport may limit stays in Canada to below allowances for tourists, as it’s a secondary residential tie. It’s also easier to convince Canada Revenue you left for good if you return to your country of origin, at least initially. In cases of doubt a permanent home test may serve as a tie-breaker. And don’t bother renewing your driver’s license or memberships in organizations, as Canada Revenue might read a wish for more Canada into these.

Important: to be considered non-resident, and be rid of Canadian tax declarations and T1135s, you need to fill the relevant departure tax forms, whether or not a tax liability results.

Resident and Non-Resident Parts of Your Last Year in Canada

Your last year in Canada will be split in resident and non-resident parts unless you leaving date falls on Dec 31. Up to your departure date your world income, that is, income from sources inside and outside Canada, needs be reported. For the remaining part of the year, you must report only income from inside Canada.

That you cannot report worldwide income after your leaving date may, especially in combination with deemed dispositions, serve to increase your tax liabilities. For instance, if you had a deemed disposition on crypto currency at your leaving date giving you a taxable gain, and later the year sold at a loss, you cannot offset your gains with those losses. And yes, crypto transactions are not just taxable, you also need to report your holdings on your T1135. I have no clue if that’s for the full year, or just the resident part.

Equally, gains on stock transactions past leaving date cannot be reported in your Canadian declaration, even if they were losses. This means you’ll have to remove all those T5008s from non-registered Canadian brokerage accounts that were automatically added by your tax software, if the sell date is past leaving date.

However, if you were director of a Canadian corporation which you had to resolve, then all those dividends are Canadian source income. Not just that, Canada Revenue is always concerned about justice. Therefore, your dividends, which will almost always be “non-eligible”, enter your worldwide income with a 138% multiplier. That’s because the corporation taxes you already paid were that little! Who knew!

Dispositions of Property

The whole concept of Canadian departure tax revolves around deemed acquisitions and dispositions, that is, fictitious capital gains. Canada Revenue lists the types of property relevant for departure tax. Any such property that you already had when you first became resident will be a deemed acquisition. All of it is a deemed disposition at departure date, just as if you had sold it and cashed in big.

Canada Revenue grants you a generous lower limit of $25,000 in total value of your property. Anything above is deemed rich and in for a haircut.

You don’t pay departure tax on Canadian real estate, Canadian businesses, your RRSP and registered accounts, and property you owned when you came to Canada and stayed for less then 60 months.

You also don’t need to include household effects called “personal-use property” (PUP):

- clothing

- household effects

- collectibles

- cars

Canada Revenue aren’t interested in your PUP, they want your money. And they get that from stuff valued at $10,000 or above that doesn’t regularly depreciate with time. All the rest you don’t need to list in your T1243. Say you bought a car for $50,000 worth $20,000 at departure date, then you cannot include a $30,000 loss into your deemed dispositions because the car was expected to lose value. Had it been an old-timer that increased in price, then yes, stingy Canada takes note.

However, Canada Revenue must themselves have concluded that a legitimate tax regime can’t possibly focus only on gains and exclude all losses. Therefore, they came up with a special category of PUP called “listed personal property” (LPP).

Listed personal property are:

- all kinds of art works

- jewelry

- rare books and manuscripts

- stamps and coins

Yes, your family jewelry is deemed sold, too, and Canada Revenue will take their share as LPPs are expected to appreciate. In your departure tax declaration you can deduct losses on LPP from gains on other LPP, but if you had only losses on your LPP, than you can’t deduct those from gains on other types of property.

It doesn’t help parting from valuables as gifts, as those are deemed dispositions as well even if the donee is a registered charity, or your mom, pop, uncle or nephew.

There is, however, one notable exception for precious metals. As such, investments in precious metals like gold bars are not exempt from departure tax. But coins are a type of LPP, so you don’t need to include these unless their per-item value exceeds $10,000.

You can unwind deemed dispositions and get part of your money back should you return to Canada. And then pay departure tax again next time you leave!

You could also elect to defer departure tax owing by providing adequate security. RRSPs are not accepted to my knowledge. And it wouldn’t surprise me if Canada Revenue read a wish to return into your security and instead kept you resident. So I decided to be done with and pay.

Property Valuation and Your T1135

I would be a nice touch if Canada were to include a big warning into all of their immigration brochures and new Express Entry program that those coming should value their property on arrival date. And put a mention for what purposes that valuation might later be needed.

For most exchange traded investment funds, precious metals and other liquidly traded assets, coming up with a valuation will be no problem even in retrospect. Not so for real estate. Those filing a T1135 should be asked a property valuation in their third year of residence the latest. For the first year, no T1135 is needed, and most would work on their declaration during the spring following the second year. At this point, you would want to find documentation the fair value of your property on arrival date. It’s not in your interest to underestimate the value of your non-Canadian possessions, even if this pushes you below the T1135 reporting level, as lower cost bases result in higher departure taxes!

If you can get away filing the simplified T1135 for total costs of less than $250,000, this may be preferable as it doesn’t press you to come up with an exact property valuation in your third year of residence.

Otherwise, if you do need to file using the detailed method, your property valuation will define an upper ceiling for real estate valuations on arrival date. Note the inherent foreign exchange risks! If the currency of the country you property is in depreciated against the Canadian dollar between arrival and first filing date, then your property must have had a lower value in domestic currency on arrival date. Not clear what I mean? Then I hope you get a better understanding why departure tax declarations are such fun!

As another example for currency risks, suppose your property actually lost value in your home country. Say it dropped from 100,000 dinars to 95,000 over the span of your Canadian residence. But, because of Canada’s inflationary monetary regime, the value of one dinar rose from $1 to $3. Then the 5000 dinar loss in your country of origin translates to a $185,000 gain in Canada, as your property would now be valued at $285,000. And it’s a fictitious gain on top when, at the same time, the value of all your Canadian savings dropped in terms of dinars.

For your departure tax declaration you cannot divert too far from your valuations in your T1135s without risking penalties. In your property’s domestic currency, arrival date valuations can be somewhat lower and expatriation date valuations somewhat higher than in your first and last T1135. Canada Revenue say nothing on what kind of evidence they like to see for real estate valuations, except that they need to arrive at a fair market value. It may be best to seek help from property professionals. At your cost.

Adjusted Cost Base

All items relevant for departure tax need to be listed in the T1243 and once again the T1161. On the T1243 Canada Revenue asks the Adjusted Cost Base (ACB), which will be relevant for foreign real estate.

The ACB is the cost of a property plus any expenses to acquire it, such as commissions and legal fees. On the T1243 a higher ACB will lower your fictitious capital gains and thus your tax liability, so you want to make sure to add all relevant costs. I found no hints whether the real expenses from when you purchased the property go into the ACB, or whether it’s fictitious ones you would have paid on the day you moved to Canada. Since the latter are generally higher, I opted for them. In Germany, the purchase costs comprise fees for estate agents, notarization, land registry, filing of mortgages at the land registry and possibly more. Don’t forget any!

Preparing your Departure Tax Declaration

If you don’t have a Canadian tax adviser helping you, I recommend using some standard tax software for your departure tax declaration. Since these often only accept Canadian addresses in the residence section, just put something like “invalid non-resident” as a street name and your foreign address somewhere beside. You can then fill any information from payslips, T4s and RL1s into the appropriate sections, and add the information from your T1243 under Schedule 3 (S3). Don’t create T5008s for departure tax items!

With the capital gains under S3, standard tax software will calculate your tax owing, so the main challenge reduces to getting your T1243 statement right. Which is hard enough.

Afterwards, instead of Net-File, produce PDF printouts for your federal and provincial taxes. You will then want to attach documentation and proofs for the T1243 to your federal declaration.

One reply on “Canada? Revenue Agency! Immigrants Beware!”

Hi Fritz,

sehr detaillierter Artikel und sicherlich wahnsinnig hilfreich für Einwanderer… wer rechnet mit sowas??!!

Ich finde es beeindruckend, wie klar und sprachlich ausgefeilt du die Dinge auf den Punkt bringst. Da hast du eine besondere Begabung!! Hast du vor, noch mehr über deine Reisen zu schreiben? Du hast so viel erlebt und hinterfragt Vieles sehr viel kritischer, als der Durchschnittsreidende. Ich fände es fantastisch, wenn du so eine Art Reiseführer herausgeben würdest.

Dein Logo ist klasse. Einfach und mit Wiedererkennungswert.

#meincousinwirdberühmt 😉

Xxx Eva